Memo

To: Doug McMillon, President and CEO, Walmart Inc.

Re: Appointment as Chairman of Business Roundtable

Congratulations on becoming the chairman of the Business Roundtable. As the new face of the CEO group with more than 180 members, you have an extraordinary opportunity. Don’t squander it.

A couple of weeks ago, the Roundtable put out a new Statement on the Purpose of a Corporation. Although covered widely by the media and the consultants, it was a painful statement of the obvious. Yes, businesses must conduct themselves with the interests of all stakeholders in mind. Caring for employees, including listening to them with respect, builds longevity, productivity and tamps down the likelihood of your own staff picketing against you. Dealing fairly and ethically with your suppliers creates trust, goodwill and commitment to mutual success, all of which likely leads to better deals and profit with reduced risk. Invest in your communities and they will welcome you to their town. Or at least the next town you want to open in might be less likely to block your zoning approval. Give customers value? Why is this even on the list? Treat your customers poorly and you don’t have a business. You know this already.

Do all these things right, and you will make money. The shareholders will be happy. This is not an either or.

The Roundtable’s statement shouldn’t really have been news; the reason it was is because people don’t believe any of you. They don’t trust CEOs.

“A cynical personmight observe that if the issues raised by the Business Roundtable are things CEOs really care about, why are they issuing mission statements? Why aren’t they just doing this stuff? Why haven’t they been doing it all along?” https://t.co/msq0WIAucz

— Pedro Nicolaci da Costa (@pdacosta) September 23, 2019

You have the opportunity to change how people think about CEOs. Here’s how.

Keep using Walmart’s economic might to pressure suppliers to reduce packaging and waste. Use your economies of scale to push suppliers to pay their own employees around the world a living wage and create safe working environments. Choose products for your customers that are sustainable, healthy and aren’t planet-killing. Continue to reduce the pollution that you create in communities around the world.

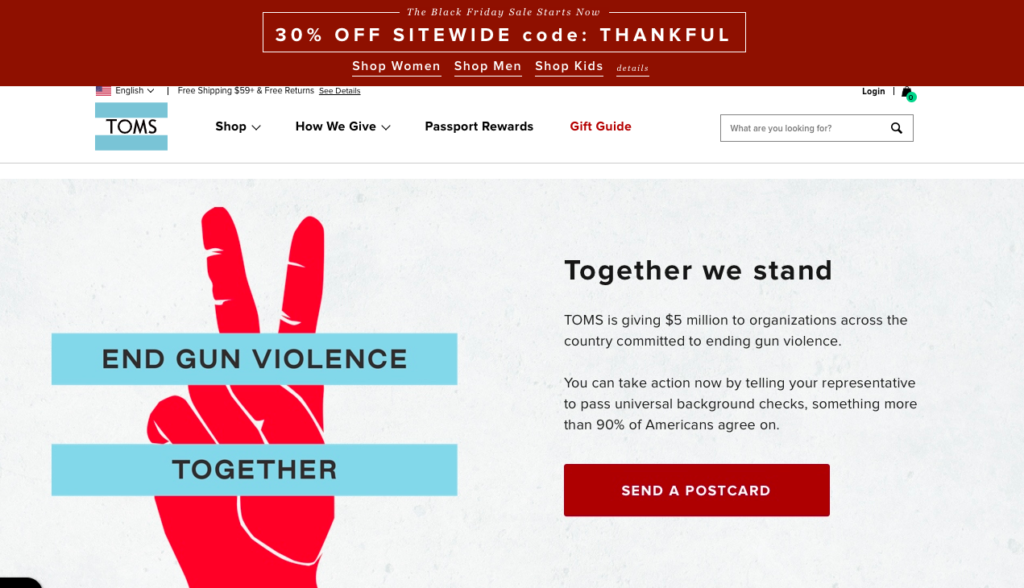

Your company has been vilified for using its power to squeeze profits out of suppliers, for killing Main Streets in small towns, for underpaying employees. Yet as CEO you’ve made real efforts to lead for good, on wages, pollution, and gun violence, with some hard decisions in recent weeks. At the same time, Walmart just reported its 20th quarter of sales growth.

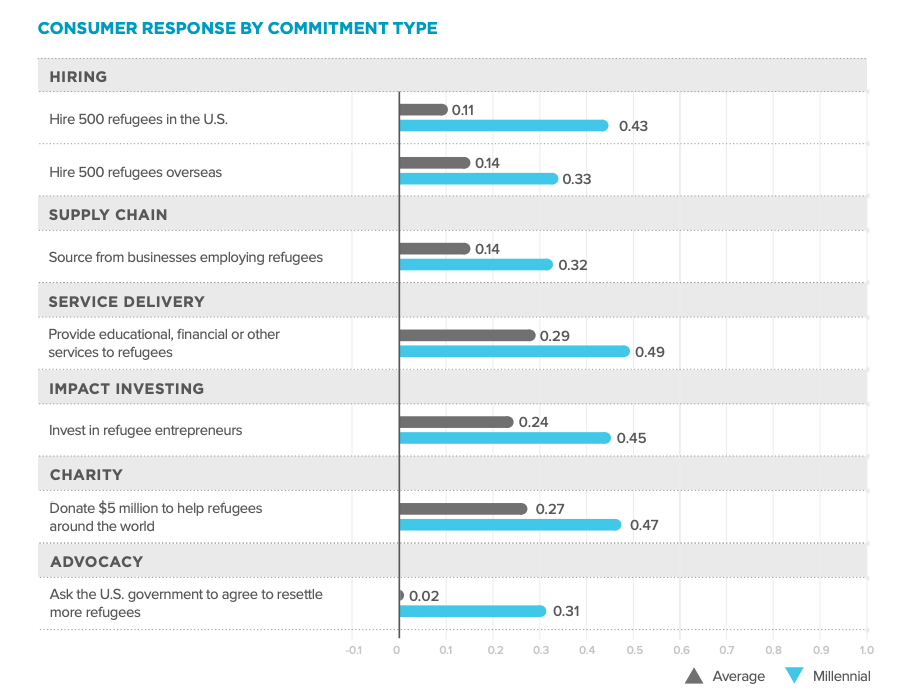

As the Roundtable chairman, here’s how you get economies of scale from your colleagues. Keep pushing for societal improvements with Walmart’s might. And then give your colleagues the data they need that shows purpose and profit can walk hand in hand. Your colleagues need case studies, proof points, and air cover from you so they can fight off doubt and dissent from controlling and activist shareholders, and from risk averse boards. The Roundtable’s statement means nothing if the individual CEOs who signed it do nothing.

Walmart’s power, by virtue of its reach across 28 countries and 11,700 stores, is to make a positive impact on people’s lives without the need for governments around the world to legislate, and to set the standard for smaller, less powerful companies to follow, without fear of Walmart taking advantage of their risk-taking. Through transparency and leadership, you can help, cajole, even shame, if necessary, the other 180 members of the Business Roundtable into doing the same.